On June 1, 2016, Ontario changed the benefits for automobile insurance, making adjustments that limit your access to long-term medical and rehabilitation benefits. This change was made quietly, and the people of Ontario were uninformed about the amendments made to their insurance policies.

On June 1, 2016, Ontario changed the benefits for automobile insurance, making adjustments that limit your access to long-term medical and rehabilitation benefits. This change was made quietly, and the people of Ontario were uninformed about the amendments made to their insurance policies.

These changes were silent but created serious consequences, leaving thousands of Ontarians affected since June 2016.

Meet Adam

Adam* purchased automobile insurance in August of 2016 thinking he had coverage that would protect him from any injuries he may obtain in the event of a motor vehicle accident.

Like every Ontarian, Adam shopped around. He knew it was mandatory to have coverage but wanted to save money, so he purchased the standard policy at the best price he could find and assumed he had the best protection available. He did not know to ask any further questions, nor did his broker make him aware of additional options available.

When Adam got into an accident in March 2017, he suffered serious injuries which were deemed non-catastrophic by his insurer. Under the new benefits limits, that meant Adam would be eligible for a maximum of $65,000 of medical rehabilitation and attendant care coverage for a fixed period of five years – whichever came first. Between his auto insurance coverage, work benefits plan, and OHIP, he and his family assumed he would be able to fully pay for the rehabilitation support he needed for as long as it took for him to recover.

Shouldn’t OHIP and work benefits have covered that?

As Adam worked on his recovery the money quickly dwindled. Adam, like many Ontarians, thought that OHIP would cover him for any costs required for treatment, with his auto policy and work benefits paying for the difference. However, he soon realized that funding through his work benefits was limited, as was the protection provided by OHIP. In fact, the majority of the treatment he needed for recovery was only available through private clinics and had to be paid for by his auto policy.

When he turned to OHIP, he was permitted 4 hours per day of personal support care. His work benefits provided no coverage for personal support care, and so he was left without support for 20 hours per day.

When he turned to OHIP, he was permitted 4 hours per day of personal support care. His work benefits provided no coverage for personal support care, and so he was left without support for 20 hours per day.

His wife was able to take a few days off work to assist him, however, he would require aid for a 3-month period. His wife was unable to take that much time from work, and so they had to find another option.

When Adam turned to his auto insurer, he learned that he was entitled to a maximum of $3,000 a month for the assistance of a Personal Support Worker (PSW) at the hourly rates set by the provincial regulations for persons injured in an auto accident.

With the actual current rate of $40 per hour, this only gave him 75 hours of attendant care per month versus the over 700 hours per month that he actually required – particularly in the first three months when he was immobile and unable to perform basic tasks for himself.

Assuming that the insurance company paid him the $3,000 a month for treatment, Adam would have used $9,000 out of the $65,000 available from his policy just on the minimal amount of attendant care support he received. Before Adam had even begun treatment, he had used up 14% of his total benefits available to him over the five-year coverage period.

Adam now needed to pay for regular physiotherapy, massage therapy, and rehabilitation therapy to begin his recovery. His employee benefits covered the first $300 of each type of therapy, but that was not going to be nearly enough.

Because of the injuries that made him non-weight bearing, Adam’s physiotherapy was in-home for the first month, followed by in-clinic treatment for months afterward. Considering that the average in-home physiotherapy session cost is $100 (plus travel time for in-home care) and that he needed 2-3 sessions per week for the near future – never mind the other types of therapy he needed, plus medication – Adam began to realize how little coverage he had.

The Five-Year Limit Surprise

Worst of all as Adam began his recovery, he quickly understood that it would not take weeks or even months, but rather years to heal. In fact, some injuries would require a lifetime of therapy to allow him to function adequately at home and, when he eventually returned, at work.

He learned that the term “non-catastrophic” was an insurance term that did not reflect the reality of his situation which felt catastrophic and life-altering to him.

Because Adam did not buy the optional benefits that would have provided him with $1 million of LIFETIME coverage for non-catastrophic injuries, he discovered, to his surprise, that his insurance company’s financial assistance would only last him for five years, or when the limited non-catastrophic medical rehabilitation benefits of $65,000 were depleted. His injuries, however, would last him forever.

Adam was forced to either give up on many parts of his recovery, trying to spread out the remaining funds over the next four years or pay thousands of dollars out of pocket. He simply could not afford to go on with therapy the way that he wanted. His life was changed forever, and insurance was not able to help.

Very often, in other cases, the five years runs out before money does, creating a very heavy financial burden on the injured person and their family over the injured person’s lifetime.

What Might Have Been

What Might Have Been

If Adam had been made aware, by his insurer or broker, of the available optional benefits, things would have been very different. For around $100 a year, he could have protected himself for life with access to up to $1 million for non-catastrophic Medical Rehabilitation Benefits and $3 million if he was deemed catastrophic.

Adam made an easy mistake. He was uninformed and thought that he was making the best decision.

Why did Adam not know? Most people shop based on price and our clients tell us that their brokers and insurance companies did not take the time to explain optional benefits to them. Without the information necessary to make an informed decision, most people choose a standard policy without knowing the risks.

Are you protecting yourself?

Since June 1, 2016 hundreds of thousands suffered personal injuries while in an automobile accident in Ontario. If you or your family ever take trips on the highway, visit family, or commute to work, it is imperative to include optional benefits in your automobile insurance policy.

June 1, 2016, is known by many personal injury lawyers as Doomsday because of the impact it had on their clients and how many lives have been altered due to Ontario’s changes to automobile insurance. These changes have put the responsibility on YOU to be aware of optional benefits and how important they are to protect yourself and your family.

What changes have been made?

Before the adjustment, regular benefits provided the following:

- medical rehabilitation benefits of $50,000 for ten years

- attendant care benefits for $36,000 for ten years

- catastrophic injury benefits for medical and rehabilitation needs of $1 million for life

- attendant care of $1 million for life

With the June 2016 update, regular automobile benefits have been changed to offer the following:

- medical rehabilitation and attendant care benefits have merged and reduced to $65,000 for five years

- the catastrophic medical rehabilitation and attendant care benefits have merged to provide $1 million in total for Life Expectancy

These changes have been made to simplify things for auto insurance companies but provide you with less support and coverage. What are you supposed to do?

The best way to protect yourself and your dependants is by signing up for optional benefits.

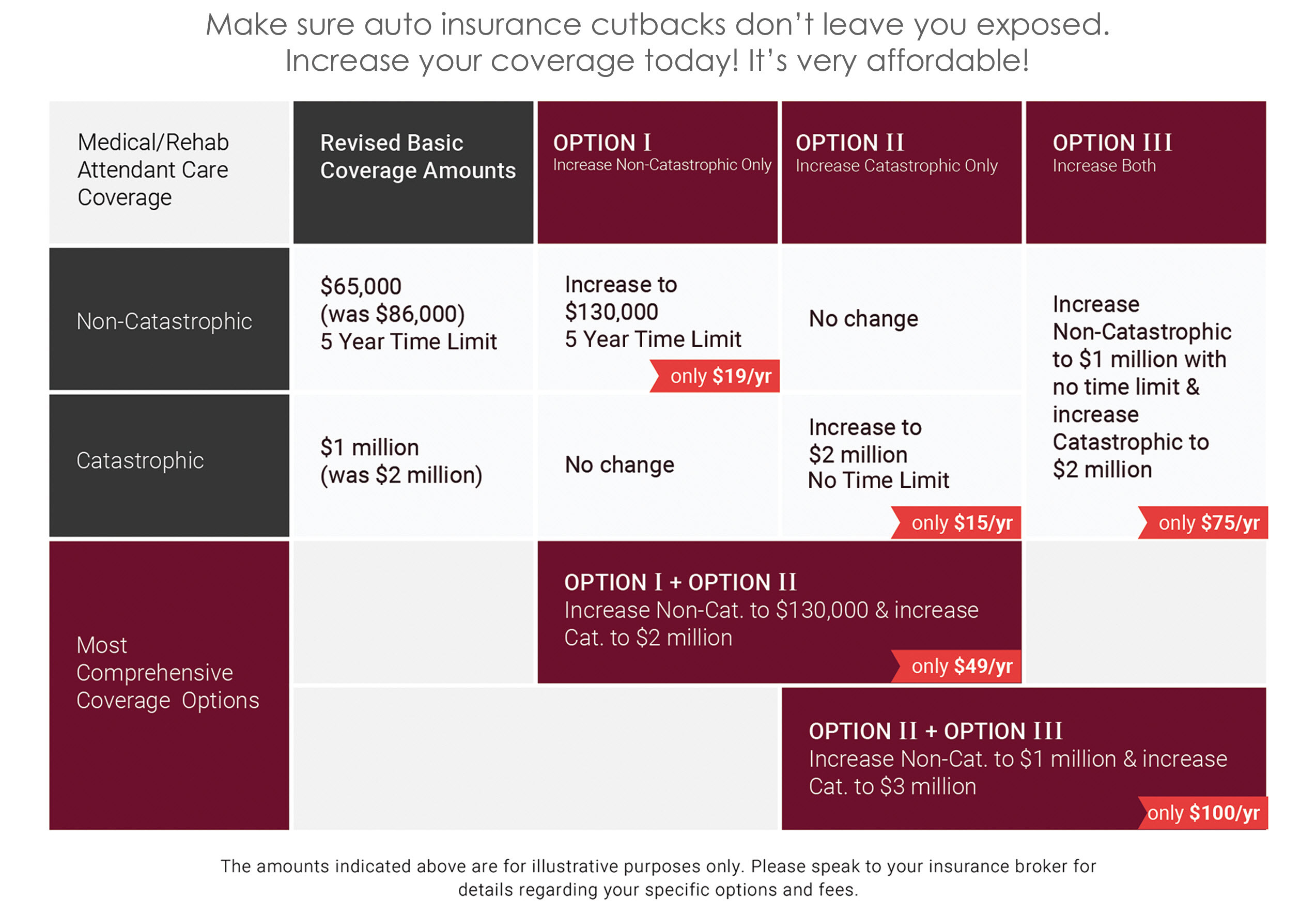

The chart below illustrates the optional Medical Rehabilitation Benefits available to you and the estimated annual costs.

Download chart in PDF to discuss with your insurer or broker.

What do optional benefits provide?

For an additional $100 a year**, you can adjust the coverage you receive in every situation.

Increase in Benefits

Adding optional benefits for non-catastrophic injuries provides $1 million in coverage for all medical, rehabilitation, and attendant care benefits needs – up from $65,000 for standard benefits.

You will also increase your support to $3 million for catastrophic injuries – up from $1 million for standard benefits. For catastrophic injuries, particularly if you are still of working age and have financial responsibilities, $1 million is not nearly enough for your support and recovery.

Protection for Dependants

It is important to note that the automobile benefits that you have carry across for not only yourself and your vehicle, but your dependants as well. Purchasing the right insurance means keeping yourself and your family protected no matter what happens.

Lifetime Coverage

As we discussed earlier in the case of Adam’s “non-catastrophic” injuries, $65,000 was only going to be available for five years, assuming the money lasted that long. In many other cases, there are funds left over when the five years expire, despite needing to continue treatment. Optional benefits last for life.

While $1 million for catastrophic injuries sounds like a lot of money, the concern lies in the five year time limit to use the money available rather than just how much your insurance offers you financially. If it is not used in the five years of support offered, it is gone.

By definition, catastrophic injuries are just that – catastrophic. In our experience, the physical, emotional, and psychological problems do not go away in five years. Furthermore, you could try a different career ten years after your accident, bringing out an old injury, and need physiotherapy to help adjust.

These injuries will impact you for the rest of your life – your insurance should protect you for life, too.

How do I get optional benefits?

Ask Your Insurer/Broker Questions

There is nothing wrong with shopping for the best price on your automobile insurance. However, once you have the best price, ask the insurer or broker to add the maximum optional Medical Rehabilitation Benefits available. Ask for non-catastrophic coverage of $1 million and catastrophic coverage of $3 million. You will be shocked to find out that only a few extra dollars per month will provide so much more coverage for you and your family.

For those who are intimidated, we encourage you to download our helpful chart to send to your insurer or broker. We have also put together two questions to ask your current insurer or broker:

- Does my policy or quote include maximum optional benefits for non-catastrophic Medical Rehabilitation Attendant Care and catastrophic benefits for life?

- If not, how much will it cost to add the optional $1 million non-catastrophic Medical Rehabilitation Attendant Care (M/R/AC) benefit for life AND the $3 million (M/R/AC) catastrophic benefit for life?

Then ask yourself: for the additional few dollars a month, can I afford NOT to protect myself and my family for life in the event of an accident?

Find the Right Insurer/Broker

A good insurer or broker will be able to provide insight on how to integrate optional benefits into your plan. Be sure to give them time to answer your questions – some may not have the information about optional benefits that you need immediately, since this change was so swept up under the rug. If you do not get the answers you need, however, consider shopping around for another insurer or broker who will advocate for you.

Once you have added the optional benefits to your plan, ask your broker to show them to you in your policy. This way you can guarantee that your benefits are there, and they are not missed.

Optional Benefits Create Peace of Mind

While there are several types of benefits and features that you can add to your policy, we encourage you to choose the highest optional benefits for Medical Rehabilitation Attendant Care offered. The peace of mind provided by guaranteeing lifelong coverage is the best support you can ask for.

Share this blog with others who might not be aware to help them better understand how they can protect themselves.

Consider also providing these benefits to others who may not know the available options. What better gift to provide your parents for Christmas, or your children who are just starting a family? Peace of mind is a better present than another gift card, or worse: another cologne.

If you have sustained a personal injury or disability, contact Foisy and Associates for a free consultation to find out how we can help.

*Real name has been changed for confidentiality

**Rates may vary depending on your provider.

What Might Have Been

What Might Have Been